BTC Price Prediction: Navigating Bullish Targets Amidst Correction Risks

#BTC

- Technical indicators show short-term bearish pressure

- Strong institutional accumulation supports long-term thesis

- Macroeconomic risks may drive Q4 volatility

BTC Price Prediction

BTC Technical Analysis: Short-Term Bearish Signals Emerge

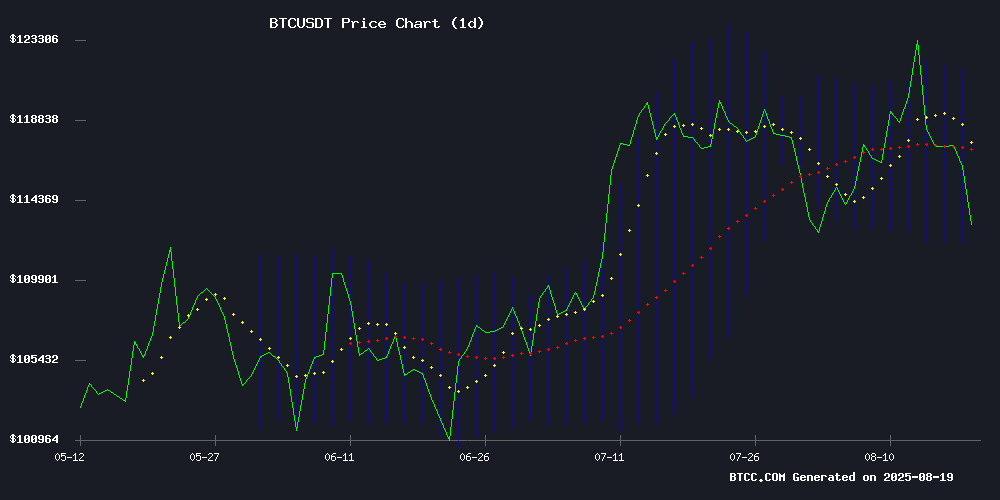

BTC is currently trading at $116,187.94, slightly below its 20-day moving average of $116,743.08, indicating potential short-term weakness. The MACD histogram remains negative at -1,097.72, reinforcing bearish momentum. Bollinger Bands show price hovering NEAR the middle band, suggesting consolidation.says BTCC analyst Michael.

Mixed Signals: Institutional Demand vs. Macro Headwinds

Positive catalysts like VanEck's $180K price target and corporate BTC holdings reaching 3.1% of supply contrast with rising exchange netflows and geopolitical risks.notes BTCC's Michael,

Factors Influencing BTC’s Price

Cryptocurrency Market Risk Management Strategies

The cryptocurrency market operates around the clock, presenting boundless opportunities alongside significant risks. Prudent investors recognize that effective risk management is the cornerstone of long-term success in digital asset trading.

Volatility remains the defining characteristic of crypto markets. Bitcoin routinely experiences 10% daily swings, while altcoins can surge or collapse by 50% or more. This extreme price action creates both profit potential and catastrophic loss scenarios.

Market risk dominates investor concerns, with prices vulnerable to sudden collapses triggered by regulatory developments or exchange breaches. Liquidity risk plagues smaller cryptocurrencies, mirroring penny stock challenges where thin order books trap investors in unfavorable positions.

Unique to digital assets, technology risk manifests through smart contract vulnerabilities and network failures—even established projects aren't immune. The specter of regulatory uncertainty looms largest, as governments worldwide grapple with appropriate frameworks that could dramatically reshape valuations overnight.

VanEck Reiterates Bitcoin Target of $180k Before End of 2025

VanEck Associates Corporation has doubled down on its bullish Bitcoin forecast, projecting the cryptocurrency will reach $180,000 by the end of 2025. Analysts Mathew Sigel and Nathan Frankovitz cite a combination of macroeconomic factors and institutional adoption as key drivers for this upward trajectory.

The firm acknowledges potential market volatility but maintains Bitcoin is more likely to break its all-time high than enter prolonged correction territory. "Macroeconomic developments and seasonal investor re-engagement could either extend Bitcoin's momentum or prompt profit-taking," the report states, while affirming the $180k target.

Political developments appear to be fueling optimism, with Bitcoin benefiting from favorable regulatory winds following the U.S. presidential election. Institutional interest continues to grow, particularly through treasury strategies and spot BTC ETFs, with 294 entities currently holding Bitcoin on their balance sheets.

Bitcoin at $100K: Golden Cross Signal Meets Holder Pressure

Bitcoin's weekly chart reveals a critical juncture as a Golden Cross formation reappears, historically a precursor to robust bull markets. The cryptocurrency now hovers mid-channel within a well-defined bullish trend, leaving traders anticipating either a retracement to support levels or a breakout toward cycle highs.

Technical analyst Mags identifies two probable scenarios: a retreat to the channel's lower band would maintain the broader uptrend, while a decisive breach of resistance could trigger parabolic upside. Market sentiment remains bifurcated, with short-term holders facing profit-taking pressure even as the 50-day MA crosses above the 200-day MA for only the fourth time in Bitcoin's history.

The Golden Cross event, noted by Merlijn The Trader, carries particular weight given its rarity and historical correlation with extended rallies. Current price action suggests institutional accumulation may be underway, though the mid-channel positioning reflects market indecision. Traders await confirmation of either consolidation or continuation patterns before committing to directional bets.

Corporate Bitcoin Accumulation Reaches 3.1% of Circulating Supply

Strategy and Metaplanet have significantly expanded their Bitcoin holdings, now controlling approximately 3.1% of the total circulating supply. Strategy's latest acquisition of 430 BTC, valued at $51.4 million, brings its total stash to 629,376 BTC—a position worth over $46 billion at an average purchase price of $73,320 per coin. The firm currently enjoys unrealized profits exceeding $27 billion as Bitcoin trades near $116,535.

Metaplanet's aggressive treasury strategy saw it add 775 BTC at $119,853 per coin, totaling $92.8 million. The Tokyo-based firm now holds 18,888 BTC acquired at an average price of $101,726, with cumulative investments reaching $1.9 billion. Since March, Metaplanet has quadrupled its Bitcoin exposure.

These coordinated acquisitions underscore how corporate treasuries are systematically draining Bitcoin liquidity from the market. The two entities now command a concentration rivaling early mining pools, signaling deepening institutional conviction in Bitcoin's scarcity narrative.

Bitcoin Faces Selling Pressure as Binance Netflows Rise

Bitcoin's record-breaking rally stalled abruptly after reaching an all-time high of $124,000 last week. The cryptocurrency has since retreated to $118,000, with analysts pointing to increased exchange inflows as a potential warning sign.

Binance, the world's largest crypto exchange, shows concerning on-chain metrics. Netflows have turned positive while outflows slow - a classic indicator of mounting sell pressure. This shift comes as traders appear to be taking profits following Bitcoin's parabolic ascent.

The market now faces a critical juncture. Whether this consolidation represents healthy profit-taking or the start of deeper correction hinges largely on Binance's flow dynamics in coming days. Exchange reserves are building at a pace that historically precedes volatility.

KindlyMD Secures $200M Convertible Note to Expand Bitcoin Holdings

KindlyMD (NAKA), a Nasdaq-listed firm recently merged with Bitcoin treasury specialist Nakamoto, closed a $200 million convertible note offering. The financing, arranged with Yorkville Advisors’ YA II PN fund, carries no interest for the first two years, followed by a 6% annual rate until maturity in 2028. Proceeds will be used to acquire additional Bitcoin.

The deal includes unconventional terms: Yorkville can convert debt into equity at $2.80 per share, potentially diluting existing shareholders. Nakamoto/KindlyMD must also pledge twice the principal amount in Bitcoin as collateral, providing the lender with substantial downside protection.

NAKA shares fell 11.2% Monday amid the funding news and a broader Bitcoin price decline. Other Bitcoin-focused firms like MicroStrategy and Semler Scientific saw smaller losses, down slightly over 1%.

Bitcoin's Record Highs Contrast With Strategy Inc's Stock Decline

Bitcoin surged to unprecedented levels in 2025, breaching $124,000 before settling near $115,000 by mid-August. Yet Strategy Inc, once the market's favored equity proxy for BTC, saw its shares tumble nearly 9%, trading a third below its 52-week high.

The disconnect highlights a seismic shift in investor behavior. Strategy's 629,000 BTC treasury—worth $72.5 billion—now commands barely any premium, a far cry from its 2.5–3x valuation multiples in 2024. Cheap debt financing has evaporated, share dilution has grown untenable, and spot BTC ETFs have democratized access to crypto exposure.

Market participants now watch the $360 support level as a litmus test for corporate Bitcoin strategies. The erosion of Strategy's premium raises fundamental questions about the viability of public companies serving as crypto investment vehicles in a maturing market.

Rural Texans Challenge Bitcoin Mining Operations Over Noise Pollution

Residents of Hood County, Texas, are escalating efforts to regulate a Bitcoin mining facility operated by Marathon Digital Holdings. The site, active for three years near Mitchell Bend, has drawn ire for its relentless industrial noise, which locals claim causes sleep deprivation, hearing damage, and plummeting property values.

A petition to incorporate Mitchell Bend as a self-governing town—a move that would enable local oversight of the mine—was initially rejected due to insufficient voter signatures. Undeterred, residents filed a second petition before the August 18 deadline, aiming for a November ballot vote. Shannon Wolf, a local Republican official, accused county leaders of poor communication regarding the petition process.

Legal action looms if the incorporation effort fails, with potential appeals reaching Texas’s highest court. The standoff underscores growing tensions between cryptocurrency infrastructure and community welfare in rural America.

Macro-Economic Factors Poised to Influence Crypto Rally in Q4 2025

The crypto market faces heightened volatility as escalating U.S. debt concerns unsettle investors. Recent data reveals a $291 billion July budget deficit—the second-largest for the month in history—amplifying fears of a debt spiral. Ray Dalio and other analysts warn of potential systemic risks.

Political developments add complexity. Former President Trump's advocacy for lower interest rates has reignited debates about debt sustainability. Meanwhile, corporate bond yields have dipped to near 30-year lows, creating an atypical risk-on environment.

With four months remaining in 2025, Bitcoin and altcoins remain buoyant but increasingly reactive to macro signals. The interplay between fiscal policy, debt dynamics, and institutional sentiment may determine Q4's trajectory.

Bitcoin Price Slips as Bull Rally Loses Momentum on Geopolitical Jitters

Bitcoin's recent rally shows signs of fatigue as geopolitical uncertainties dampen investor sentiment. The cryptocurrency trades within a tight range between $115,025 and $121,853, reflecting cautious market behavior. Despite the short-term dip, technical indicators suggest potential upside if key resistance levels are breached.

Over the past six months, Bitcoin has surged more than 20%, demonstrating resilience amid volatility. A breakout above $126,206 could pave the way for an 8% climb toward $133,033. Low RSI and stochastic readings hint at accumulating bullish momentum.

The broader crypto market mirrors this cautious optimism. Projects navigating this environment increasingly rely on data-driven communication strategies to maintain clarity during turbulent cycles.

Twitter Founder Jack Dorsey Latest Suspect in Satoshi Nakamoto Identity Mystery

The enigma surrounding Bitcoin's creator takes another speculative turn as Jack Dorsey enters the fray of potential Satoshi Nakamoto candidates. The Twitter co-founder's early advocacy for decentralization and technical prowess—including writing dispatch software at age 15—fuels renewed conjecture about Bitcoin's origins.

Dorsey joins a long list of speculated identities, from cryptographers Hal Finney and Nick Szabo to the widely disputed claims of Craig Wright. The enduring mystery persists despite forensic analyses of Bitcoin's 31,000 lines of original code and countless online investigations.

Market observers note such speculation typically generates transient volatility for BTC, though the asset's fundamentals remain detached from creator mythology. Dorsey's payment company Block continues advancing Bitcoin adoption through hardware wallets and mining initiatives, regardless of his connection to Satoshi.

Is BTC a good investment?

BTC presents a high-risk/high-reward proposition at current levels. Key considerations:

| Metric | Value | Implication |

|---|---|---|

| Price vs. 20-DMA | -0.48% below | Short-term bearish |

| Institutional Holdings | 3.1% of supply | Structural demand |

| VanEck Price Target | $180K | 55% upside potential |

BTCC's Michael advises: "Dollar-cost averaging and strict risk management are essential given the conflicting technical and fundamental signals."

Technical indicators show short-term bearish pressure

Strong institutional accumulation supports long-term thesis

Macroeconomic risks may drive Q4 volatility